As June 30 approaches, it’s the perfect time to get organised, maximise your deductions, and make smart financial choices before the tax year wraps up. Whether you’re a busy parent, a small business owner, or simply looking to take control of your finances, the End of Financial Year doesn’t need to be stressful. Here are some practical tax-time tips to help you feel more prepared—and even save some money.

1. Keep Your Receipts

Start by gathering receipts and invoices for any work-related or deductible expenses. These might include:

- Work-from-home costs (e.g., electricity, internet, office equipment)

- Uniforms or protective clothing

- Tools, technology or subscriptions directly related to your job

- Donations to registered charities

Tip: A low-cost stationery kit from The Reject Shop can help you stay organised—grab a folder or file to keep receipts and documents sorted all year round.

2. Claim Work-Related Expenses

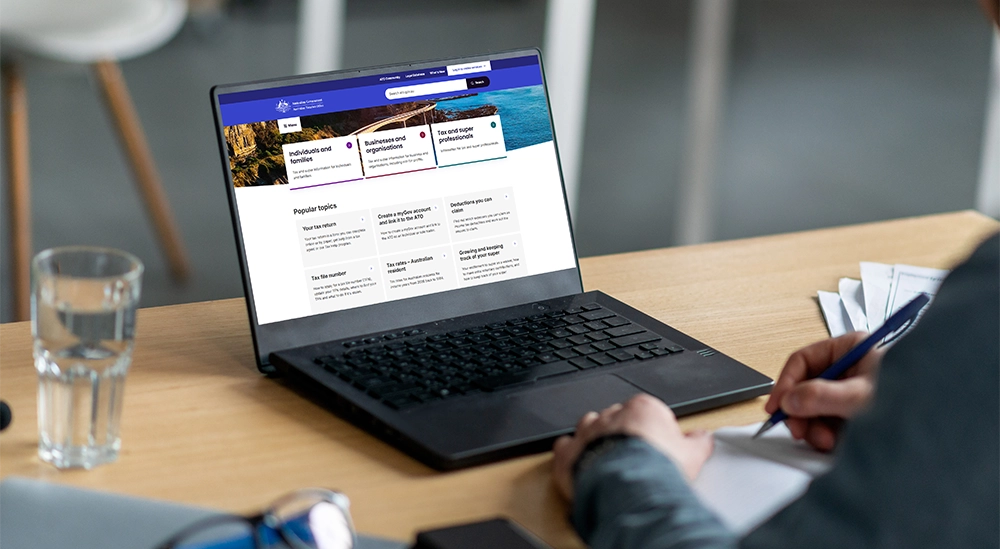

If you’ve spent money that relates directly to earning your income, you may be able to claim it. The Australian Taxation Office (ATO) has a handy occupation-specific guide to help you understand what you’re entitled to claim.

3. Shop Smarter Before June 30

EOFY sales aren’t just for scoring deals—they can also be an opportunity to purchase tax-deductible items. If you’re a sole trader or run a small business, investing in office supplies, tech gear, or even tools before June 30 can count as a legitimate business expense.

Explore EOFY specials at Smokemart & GiftBox, TerryWhite Chemmart, and Woolworths to pick up household or personal wellness products that may be relevant.

4. Health Check: Use It Before You Lose It

If you’ve got extras cover as part of your private health insurance, now’s a great time to use any remaining dental, optical or allied health benefits before they reset.

Visit Amplifon for a hearing check, or schedule a wellness consult at TerryWhite Chemmart while you’re at Raymond Terrace Central.

5. Know What’s New This Year

Tax rules can change from year to year. Visit ato.gov.au to read up on any new deductions, thresholds or offsets for the 2023–24 financial year. You may even find you’re eligible for deductions or credits you weren’t aware of!

6. Consider Professional Help

While it’s tempting to DIY your tax return, speaking to an accountant or registered tax agent could save you time and possibly increase your refund. They can help you claim all you’re entitled to and stay compliant with changing rules.

EOFY Essentials, Right Here at Raymond Terrace Centra

From smart shopping to staying organised, Raymond Terrace Central is here to support you through tax time. Make the most of the EOFY period with helpful supplies, great deals, and everything you need under one roof.

Happy tax season!